This article discusses how CMS determines payment, which fee schedules change throughout the year and what is out of your control to change. If you'd like to know more about solutions to unlock better rates in 2022, check out this free, on-demand webinar.

Understanding fee schedules

Many fee schedules change annually (e.g., CMS RBRVS, CMS DME POS, CMS Clinical Lab and CMS ASC) or quarterly (e.g., CMS ASP Drug). As a medical billing expert, you're always dealing with changing fee schedules, especially since all of the aforementioned dynamic schedules are for one payer that's probably significant for your practice: Centers for Medicare and Medicaid Services (CMS).

Unlike commercial payers you can negotiate with for greater reimbursement, CMS controls what your fee schedule looks like every year, or in the case of drugs, every quarter year.

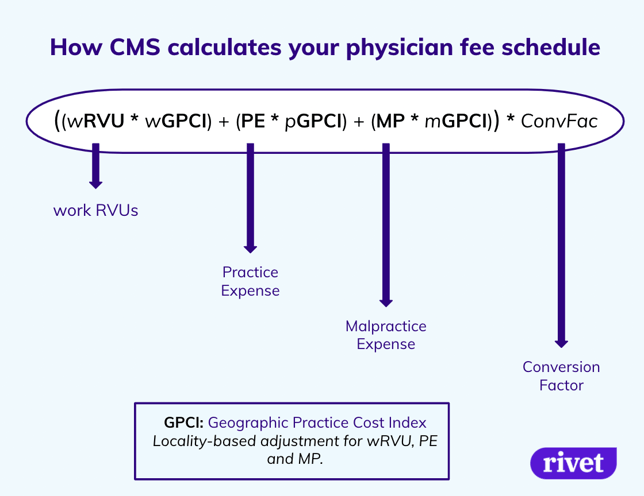

CMS determines how much a U.S. physician is paid for an item or service using the following formula:

There are three major components to the calculation of a CMS physician fee schedule: work RVUs, practice expense and malpractice expense.

A work RVU, or a work Relative Value Unit, is a standardized unit of productivity across all providers nationwide. Everyone across the country uses the same RVU scale.

The other two (practice expense and malpractice expense) are fairly self-explanatory. They're essentially the costs to maintain a practice, including malpractice insurance.

A Geographic Practice Cost Index (GPCI) has been established for each of the three components and adjusts the amount for the locality. This means that the GPCI takes into account the higher cost of living in Manhattan than the cost of living in South Dakota. States generally have multiple "localities" that provide a specific adjustment amount for a given area within a state.

After everything is multiplied and added, the total is multiplied by the Conversion Factor, or the dollar amount per RVU.

CMS Final Rule for 2022

The conversion factor is lower in 2022 than it was in 2021.

What is the change?

Why is it lower?

In order to bridge the gap from lost revenue due to the pandemic, the Consolidated Appropriations Act (CAA) allowed for a temporary increase in the conversion factor of 3.75%, which is now over (with the end of 2021).

Note:

Ambulatory Surgical Center (ASC) fee schedules are structured for facilities that own their own ASC or provider groups that have an ownership stake in an ASC.

ASC fee schedules are calculated in the following way:

Payment Rate = (Labor * Wage Index) + Non-labor component

There are two components to an ASC fee schedule: labor and non-labor.

The labor component is adjusted by a wage index, which is calculated by a Core Based Statistical Area (CBSA). The CBSA is very similar to GPCI locality as stated above. The non-labor is added at the end. Both are based on a relative base weight and the conversion factor determined by CMS.

A manufacturer's ASP must be calculated by the manufacturer every calendar quarter and submitted to CMS within 30 days of the close of the quarter. Since change occurs 4x a year, your fee schedules are essentially dynamic and ever changing.

Often HCPCS codes that start with "J" are these dynamic ASP drug codes.

Important Note: Many commercial payers adopt quarterly changes with a lag since the changes happen quite frequently.

Now that we've talked about how your rates will change in the coming year as CMS determines it will change, let's talk about how you should think of it as it pertains to you.

These are changes that happen to you, as the provider, and are not entirely anticipated.

1. RVUs (or Total RVUs): the formula listed in the graphic above

a. wRVUs

b. Practice Expense (PE)

c. Malpractice (MP)

d. Geographic Practice Cost Index

2. Added/Removed CPT or HCPC codes (e.g., COVID tests or other things that get added or removed throughout the year)

3. Conversion factor changes (CMS determines this change.)

4. Changes to incentive programs (CMS determines this change.)

5. ASP Drug pricing volatility

6. Respective changes to payer schedules

a. Aetna MFS, Cigna RBRVS, Humana Choice Care, etc.

Unlike dynamic changes, planned changes are readily determinable, meaning you can adequately anticipate them in the coming calendar year without much upset (typically) after they have been laid out in a final rule or the negotiation period has passed.

Unplanned changes, however, are changes you may have goals for in the coming year, but upsets such as employee turnover or failed collection from patients could completely turn on its head.

These planned and unplanned changes are as follows:

|

Planned Changes CMS Updates (proposed July/August of previous year) Amendments Contract Negotiations Assessment of risk-based penalties |

Unplanned Changes Payment rate changes |

Note: Payer contracts may give payer's the authority to change their proprietary fee schedule with little-to-no notification requirement.

We've talked about what your experience with fee schedules will be like in 2022, but we haven't gone into what to do about it.

Want to know more about what to do about your rates in 2022?

Find out more in our free, on-demand webinar here:

*We ask about your name, work email, work number and job.*

Rivet offers software solutions that integrate with your EHR for up-front patient cost estimates (that complies with the 2021 No Surprises Act), as well as denied and underpaid claim solutions. To see a demo and discuss billing pain points, schedule a demo with a Rivet business development representative.

To see a quick one page synopsis of our three products, click the button below for a free PDF.