As deductibles continue to rise and more financial responsibility is placed upon the patient, the urgency to improve patient collection timelines becomes more crucial. In fact, one of our customers at Rivet recently commented, “For the first time in my experience managing a practice, our patient A/R is greater than our insurance A/R!”

Rising out-of-pocket costs lead to increased patient A/R, and as this shift becomes the norm, now is the time to set up systems that will accelerate cash flow through up-front collections.

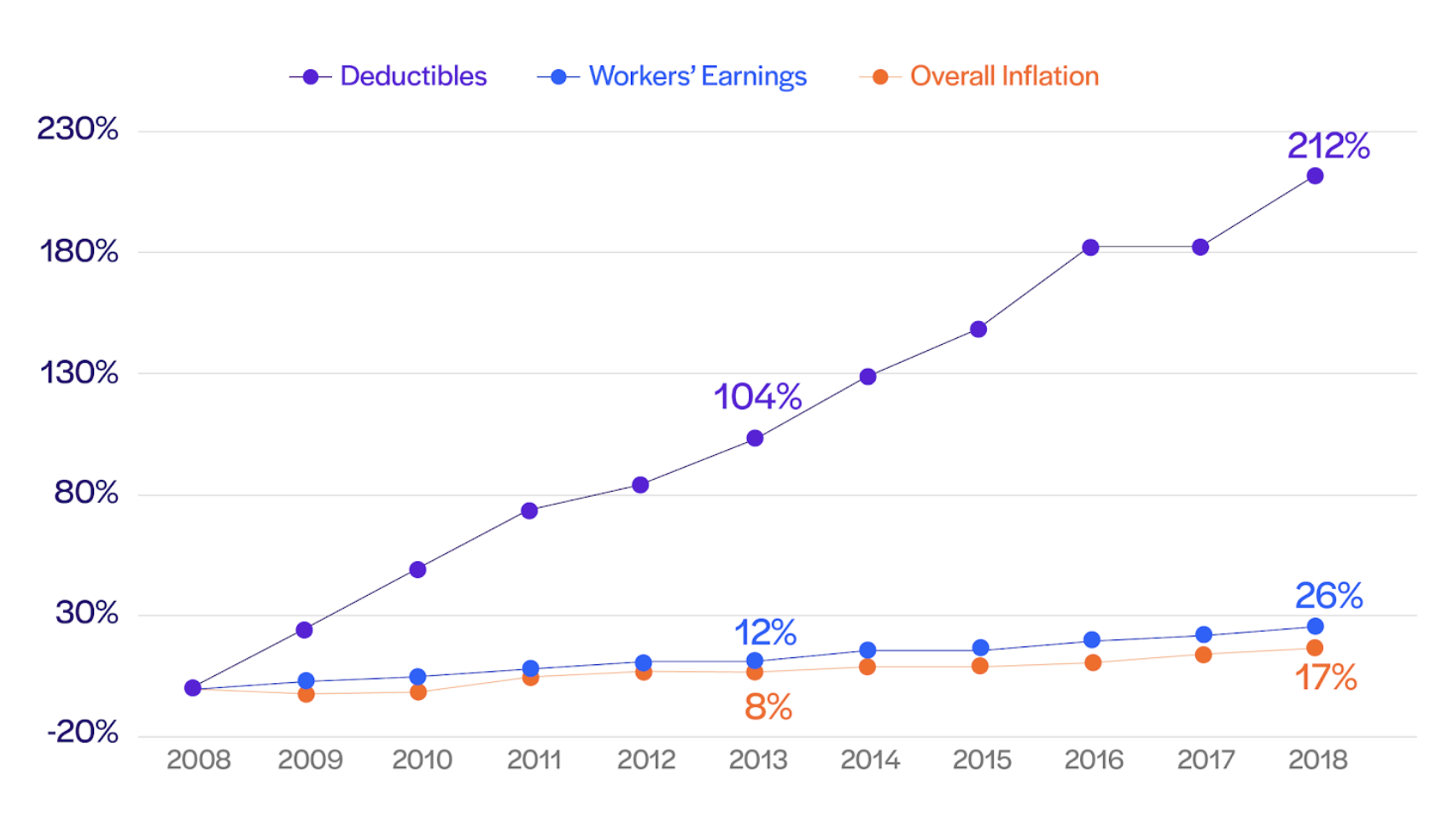

Note: Average general annual deductibles are among all covered workers. Workers in plans without a general annual deductible for in-network services are assigned a value of zero.

Source: KFF and KFF/HRET Employer Health Benefits Surveys. Consumer Price Index, U.S. City Average of Annual Inflation (April to April); Seasonally Adjusted Data from the Current Employment Statistics Survey (April to April)

Since 2008, general annual deductibles for covered workers have increased eight times as fast as wages. Deductibles have skyrocketed as a result of a different dynamic in health insurance plans, and in the case of high-dollar visits, we are seeing the meat of the residual balance falling on the patient. These types of balances can be stressful for both the patient and the physician, and 67% of Americans say they are either very worried or somewhat worried about unexpected medical bills.

Since patient collections are becoming a more relevant problem as the out-of-pocket costs increase every year, now is the time to work to increase your patient’s propensity to pay through an improved payment experience. This begins with:

One major side effect of the rise of high-deductible health plans is the shift to patients becoming consumers. Communication with patients in the modern (and Covid) era should look different than it has before. As a result, your practice must work to leverage the comfortable platforms that patients use, such as their phones and computers.

In order to embrace new technology and more effectively reach patients, it might be time to employ the following tools:

Working to create an up-front patient collections experience will enable your practice to collect more efficiently, be more transparent, and improve patient satisfaction.

It’s likely that in your office you have spent time developing systems for clinical care optimization and creating an effective patient workflow. However, when it comes time to collect payment there is often high friction around alleviating bills. This is likely because of the complexity surrounding patient billing.

One way to remedy this is to incorporate modern payment methods to make it easy to pay such as mobile pay, web pay, flexible cards (HSA/FSA, debit, credit), and card-on file auto payments. Providers should also provide multiple avenues for a patient to pay such as over the phone, through a patient portal/website, or at the point of service.

We suspect that in your practice you have some kind of payment plan policy. However, too often a great deal of discretion goes into its actual application, which can result in issues. A couple of ways we recommend remedying this scenario are:

Knowing what to look for in terms of at-risk accounts can help you to act quickly to employ policies and procedures that will allow you to avoid missing out on payments. Some at-risk red flags include:

Working to create an up-front patient cost experience that accelerates your cash flow earlier in the revenue cycle might seem overwhelming at first, but by working to incorporate policies and procedures that will increase transparency and reduce friction within the collections process, you will begin to see positive changes in your collection practices.

This is an excerpt from the webinar "Accelerating Cashflow Through Up-front Collection". Watch the full webinar here.

Read also:

Deploying Collection Initiatives for Up-front Cashflow